What is it?

Financing premiums for life insurance is optimal for all parties involved. Lenders like it because it represents a well-secured long-term loan. Insurance companies like it because it generates a stream of relatively large premiums. Agents and clients stand to benefit from these common objectives. Most importantly, premium financing solves a longstanding problem for the high net worth individual. Premium financing addresses the need for estate or business planning without requiring the expenditure of dollars for premiums or out-of-pocket expenses for interest payments. In this way, the client's cash flow and/or investments need not be liquidated to fund the needed policy; the client's investment portfolio can continue to grow without interruption; and the client's estate is protected at death. Moreover, there is no gift tax associated with the payment of large premiums because the money is now borrowed rather than paid out of the estate.

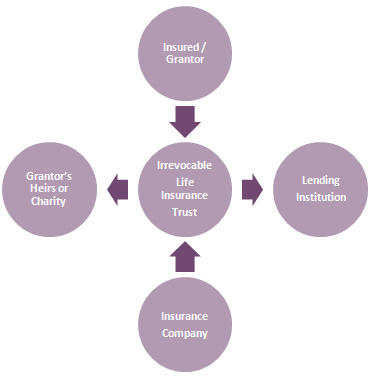

A schematic of the transaction follows:

Basic characteristics include:

- Life Insurance Premium Finance structures are powerful leveraged transactions which permit high net worth individuals to finance the purchase of large amounts of life insurance at very competitive borrowing rates.

- An irrevocable life insurance trust is the borrowing entity. The only asset of the trust is the life insurance policy.

- Premium Finance transactions require the use of life insurance policies that have a cash value component. For this reason, Premium Finance relies primarily on the use of Universal Life (UL) or Index Universal Life (IUL) Insurance Policies.

- The lender takes an assignment on the death benefit equal to the loan plus interest.

- The balance of the death benefit is paid tax free to the trust beneficiaries.

- Universal Life is a type of life insurance based on an account value. That is, an account is established with the insurer which is credited each month with interest and debited each month by a cost of insurance (COI).

- The Insured has the option to increase the premium payments or make lump sum contributions.

- The Insured can pay less than the scheduled premium and let the policy's accumulated cash value pay the remainder of the monthly charges.

- The interest credited to the account is determined by the Insurer and is often tied to a financial index or benchmark.

- UL policies guarantee a minimum return on the account value.

The Burgess Group (TBG) is currently in a unique position to capitalize on its extensive resources and high levels of expertise surrounding Premium Financed Life Insurance. Specifically, TBG can claim the following:

- Leading edge technology

- Common administrative platform providing a balanced team approach

- Systematized client/agent development, education and training

- Standardized presentations

- Practical knowledge about how to design cases and actual experience closing them

- Standardized documents and processes to assist with underwriting and financing

- Unique ability to minimize risks associated with these transactions

Finally, with scores of collateralized premium financed cases under its belt, TBG takes advantage of its strength and experience and finds creative solutions for high net worth individuals' estate planning needs.